Investing wisely is crucial for securing a stable financial future. For families looking to optimise their investments. Forming a Family Investment Company (FIC) can be a game changer. In this article we will explore the concept of a Family Investment firm. Its benefits are how to set it up and why it could be your ultimate path to financial growth.

Maximising financial growth is essential for a stable financial future. Discover how forming a Family Investment Company (FIC) can revolutionise your investments and guide you towards lasting prosperity.

Understanding Family Investment Companies

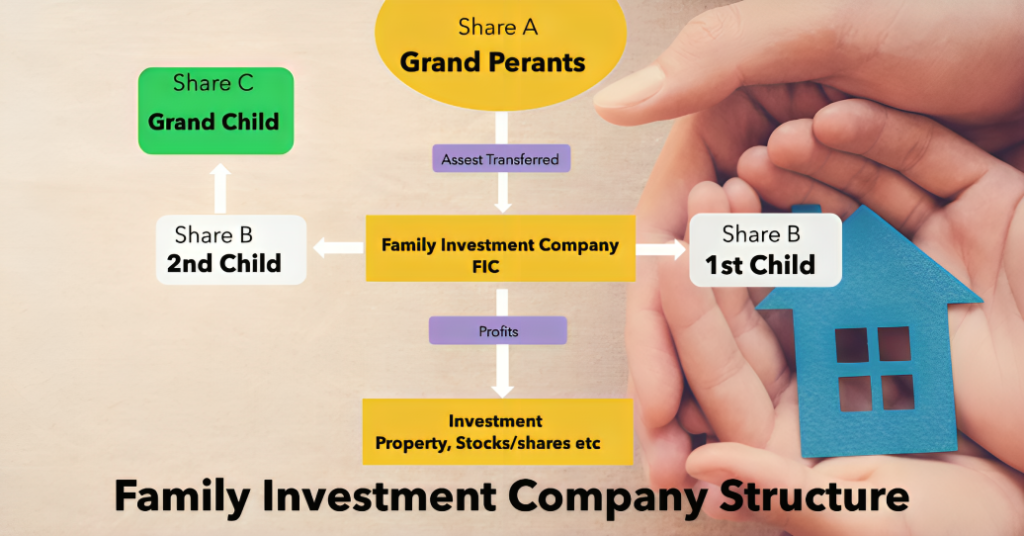

A Family Investment Company is a privately held entity that manages a family investment assets and wealth. Unlike traditional investment vehicles. FICs offer distinct advantages that cater to families’ unique needs and goals. By pooling resources. Families can access various investment opportunities that might otherwise be beyond their reach.

The Benefits of Establishing an FIC

1- Shareholding and Control

In an FIC family members typically hold shares in the company. This ownership structure provides several benefits related to control and decision-making.

- Family Involvement: Family members have direct influence over company decisions, including investment strategies asset allocation and other business operations. This ensures that the company’s direction aligns with family values and long term goals.

- Preservation of Legacy: Through shared ownership, family values, traditions and principles can be integrated into the company activities. Preserving the family legacy for future generations.

- Stability and Unity: By participating in the decision-making process. Family members often develop a stronger sense of unity and shared purpose. Fostering better communication and collaboration within the family.

2- Tax Advantages

FICs offer several income tax advantages that can be beneficial for families seeking to manage their tax liabilities more effectively:

- Income Splitting: FICs allow income generated within the company to be distributed among family members as dividends or other forms of compensation. This enables the family to allocate income to family members with lower tax brackets reducing the overall tax burden.

- Dividend Taxation: Dividends received by shareholders from the FIC might be subject to more favorable tax rates than other types of income. such as earned income.

- Estate Planning: FICs can be used for efficient estate planning. As ownership shares can be passed down to heirs with potential tax advantages compared to other forms of inheritance.

- Control over Timing: Family members can exercise control over when and how income is distributed. Allowing for strategic tax planning based on each family members financial situation.

3- Asset Protection and Management

- Consolidation of Assets: FICs provide a structured way to consolidate family assets. Making it easier to manage investments, monitor performance and make informed decisions collectively.

- Creditor Protection: Assets held within an FIC may be shielded from creditors offering protection in case of legal claims against individual family members.

4- Flexibility and Customization

- Tailored Investment Strategies: FICs allow families to design investment strategies that suit their financial goals, risk tolerance and preferences.

- Adaptability: FICs can adapt to changes in family circumstances and financial needs over time. Allowing for adjustments in investment approaches and distribution policies.

Collaborate with a seasoned tax advisor to uncover potential exemptions, reliefs, and strategies that can substantially slash or even eliminate your tax obligations related to Family Investment Companies (FICs). Get in touch with our team.

Setting Up Your Family Investment Company

- Legal Structure and Incorporation: The legal structure you choose for your FIC is pivotal. It impacts factors such as liability, governance and taxation. Consulting legal experts to determine the most suitable structure is crucial.

- Shareholding and Control: Decide on the shareholding pattern and the division of control among family members. Clearly outlining roles and responsibilities helps prevent conflicts down the line.

- Investment Strategy and Objectives: Craft a comprehensive investment strategy that aligns with the family financial goals. Whether it’s wealth preservation or aggressive growth. A clear strategy guides decision-making.

Tax Advantages of FICs

A Family Investment Company (FIC) has tax benefits. It lets families share income between members to lower taxes. You can give and move shares to pass on wealth with less Inheritance Tax. FICs also help manage capital gains tax by transferring shares smartly. They are flexible letting you decide to keep or share profits based on your family money plans.

Managing a Family Investment Company

Effectively looking after a Family Investment Company is really important to make sure it runs smoothly. People involved need to pay close attention to details review investment strategy and regularly check how well things are going. The things you need to do include:

- Sorting out any necessary tax returns and paperwork.

- Making sure investments match the company’s goals.

- Following all the legal rules and regulations to avoid problems and fines.

- Creating and changing the Articles of Association and Shareholder’s Agreement.

- Keeping accurate money records and getting the yearly accounts ready.

- Watching and writing down all the money coming in, going out, and investments made.

- Checking that the company directors are doing their jobs.

- Having regular meetings to talk about what the company wants to do.

Learn more about Uk Property tax

How Can WSPTAX Team Help You?

If you are looking to protect your family assets lower your inheritance tax and have more control over your wealth. A Family Investment Company (FIC) could be a great option.

Working with a professional tax advisor is really important to set up your Family Investment Company in the best way for taxes and following the rules. They can also guide you identify areas where you can save money or face risks and help you on how to deal with them.

By keeping an eye on tax laws and adjusting the company setup accordingly. We Save Property Tax (WSPTAX) Team can make sure your Family Investment Company stays tax efficient and does everything it’s supposed to under the law. This provide you peace of mind about your family future.